As we head into another year, many/some/a few are pondering/asking/speculating if a potential/an impending/a looming housing market crash is on the horizon for 2025. Interest rates/Mortgage costs/Loan expenses have been steadily rising/fluctuating wildly/increasing steadily, and demand/buyer interest/housing sales has cooled somewhat/experienced a significant decline/started to slow down. Some experts/Financial analysts/Market observers predict/believe/forecast that these factors could culminate/lead to/result in a correction/a downturn/a crash in the housing market/across various regions/within certain segments.

However/Conversely/On the other hand, others/A number of economists/Analysts within the industry argue that/maintain that/point out that the current housing market/real estate sector/market conditions is fundamentally sound/relatively stable/more resilient than in past crashes/previous recessions/historical downturns. They cite/highlight/emphasize strong job growth/low unemployment rates/a healthy economy as reasons for optimism/indicators of a robust market/factors supporting stability.

Ultimately/In conclusion/At this stage, it is difficult to predict/impossible to say with certainty/unclear whether or not a housing crash will occur in 2025/we will see a significant decline in housing prices/the market will experience a major correction. Only time will tell/The future remains uncertain/We'll have to wait and see how these economic factors/market trends/shifting conditions unfold.

Forecasting the Housing Market: Predictions for 2025

As we navigate a rapidly evolving economic landscape, interpreting the housing market in 2025 presents a compelling challenge. Experts predict significant shifts driven by trends like evolving interest rates, growing demand in specific regions, and growth of innovative approaches. While variable market conditions persist, potential outcomes include equilibrium, slight price appreciation, or {aadjustment.

- Moreover, governmental changes and global events could materially influence the housing market trajectory.

- Hence, purchasers should meticulously evaluate their individual circumstances and seek guidance from trusted financial professionals.

Rally or Bust? The Housing Market in 2025

Predicting the future of the housing market is a notoriously difficult task. In 2025, analysts are divided on whether we'll see a thriving boom or a severe crash. Several factors contribute this ambiguity, including fluctuating interest rates, inflation, and the overall financial landscape.

Some believe that strong buyer interest coupled with limited supply will propel prices increasingly, fueling a prosperous market. Others emphasize the potential for rising interest rates to dampen demand, leading to a stabilization in prices or even a drop.

The future of the housing market persists ambiguous. Only time will reveal which prediction will become reality.

Crash in Housing Prices Next Few Years?

The read more housing market has been hot/sizzling/booming for years, but whispers of a correction are starting to emerge. This raises the question: Will housing prices crash in the next few years?

Experts are divided/offer conflicting opinions/present a mixed bag on the outlook for the market. Some believe that/predict/forecast prices will continue to climb/rise/increase, while others caution against/warn of/advise caution about a potential bubble bursting/prices falling sharply/a significant correction.

- Several factors/A confluence of circumstances/Multiple influences

- are at play/contribute to the uncertainty/shape the market's trajectory

Interest rates/Mortgage costs/The cost of borrowing are rising/increasing/climbing, which can dampen demand/slow down the market/make homes less affordable. Supply chain issues/Construction delays/A shortage of available inventory are also putting upward pressure on prices/contributing to higher costs/making it harder for buyers to find homes

Ultimately, whether or not housing prices crash in the next few years remains to be seen/a matter of speculation/an open question. Only time will tell what the future holds/how the market will evolve/the direction the market will take.

Analyzing the Uncertainties of the 2025 Housing Market

The housing market is constantly in flux, making it a daunting arena for both buyers and sellers. As we head towards 2025, several factors influence to a extremely uncertain market landscape. Loan rates remain a key factor, with their fluctuations significantly affecting affordability and demand. Economic circumstances are also volatile, potentially influencing buyer sentiment and housing prices.

- Policy interventions, such as changes in tax legislation, can significantly impact the market.

- Online advancements are regularly transforming the real estate industry, offering both challenges and risks.

- Demographic shifts, including an aging population and changing household structures, significantly shape housing demand.

Consequently, navigating the 2025 housing market will demand careful evaluation, a adaptable approach, and a willingness to adapt strategies in response.

The Future of Real Estate: A Look at the 2025 Housing Market

As we embark into the next few years, the real estate landscape is poised for significant transformation. In 2025, the housing market is anticipated to witness a surge in innovative technologies that are altering the way we buy, sell, and experience properties. Immersive reality tours will become increasingly widespread, allowing buyers to visualize homes from anywhere in the world. Smart technology will rise in popularity, offering enhanced efficiency and making homes more eco-friendly.

The rise of remote work is also foreseen to influence the housing market. Buyers will likely seek out homes with dedicated work areas and high-speed internet access.

- Millennials, currently the largest generation of home buyers, will continue to drive market trends.

- City living will continue to be a major trend in real estate development.

The future of real estate is bright and full of potential. By embracing advancements, the industry can meet the needs of evolving consumer preferences and create a more efficient housing market.

Luke Perry Then & Now!

Luke Perry Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Amanda Bearse Then & Now!

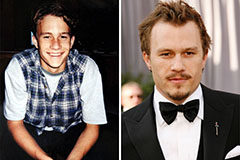

Amanda Bearse Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now!